Inflection Point

Singapore lowered the DORSCON level from Orange to Yellow in the latest loosening of Covid-19 restrictions. S-REITs (Real Estate Investment Trusts) are in a good position to benefit from re-opening. We have started to see some promising data from Retail and Office REITs. According to SGX Research, Singapore’s Central Business District (CBD) saw Grade A office rents record the fastest quarterly growth since rents turned around in Q2 2021.

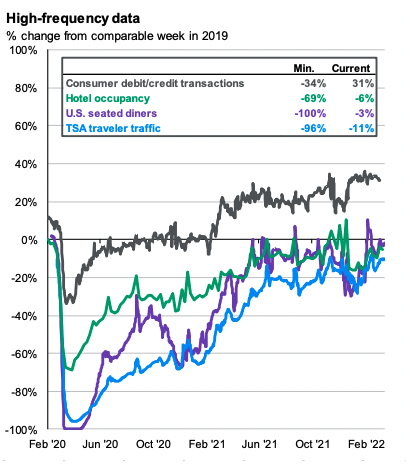

In other areas where restrictions have been loosened, cases have been increasing but hospitalisations have remained low. With re-opening gaining momentum, sectors such as leisure and hospitality are set to gain.

Airlines are growing more confident that air travel has reached an inflection point – mask mandates are being dropped in the US and volumes have recovered, only 11% lower than a comparable week in 2019. Airlines like Delta and United are providing optimistic forward guidance on projected profits for Q2 2022 and their ability to pass on higher costs to customers.

Source: JP Morgan Asset Management, Q2 Economic and Market Update

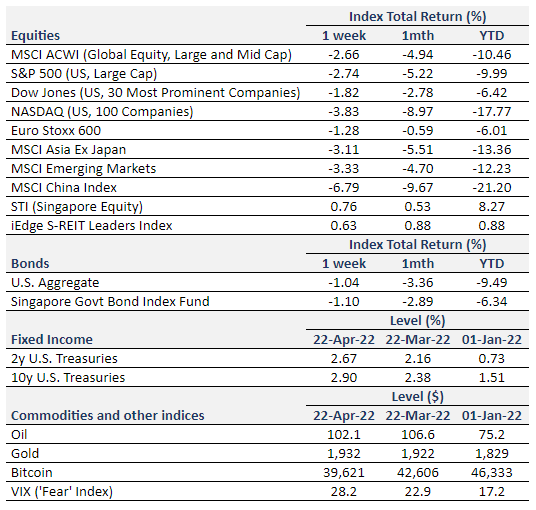

We covered key market moves here.

IMF Cuts Global Economic Forecasts

The latest April update of the World Economic Outlook (WEO) puts world output growth at 3.6%, down from 4.4% in the January forecast. Russia’s invasion of Ukraine and the sanctions imposed on Russia were the main factors contributing to the downward revision. Russia intensified attacks against the eastern region of Ukraine last week, shifting from attacks on the front lines to using long range artillery barrages and smaller troop deployments, this next stage of the war would be pivotal.

IMF expects China to grow at 4.4%, below the 5.5% target set by the government. After cutting the bank reserve requirement ratio (RRR) last week, PBoC, China’s central bank, left the loan prime rates (LPRs) unchanged. This demonstrates that PBoC wants to encourage consumption and investments by SMEs but will stop short at encouraging credit-fueled growth that buoyed the real estate sector years ago.

Powell Sets the Stage

Mr. Powell, chair of the Federal Reserve, signaled on Thursday that the central bank is ready to be more aggressive in fighting inflation. A double hike of 50bps “will be on the table for the May meeting”. From the minutes of the March FOMC meeting, balance sheet reduction will happen at twice the pace as compared to that in 2017-2019. This move will remove a large owner of US Treasuries and Mortgage Backed Securities (MBS) and push yields higher. Market participants are pricing in more hikes and greater possibility of front-loading these hikes.

30 year fixed mortgages hit 5% for the first time since 2011 and unsurprisingly, the number of mortgage applications have fallen. A key question is whether the Fed will be able to tap on the brakes without slowing the economy down entirely and tipping it into a recession.

What’s Ahead

Big week for Tech stocks next week with Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG), Amazon (AMZN), Meta (FB) reporting next week. Next week, we will also get the Caixin China General Manufacturing PMI, which offers a glimpse into China’s manufacturing health amid rounds of lockdowns in large cities.

Where could markets go from here?

Risks to growth have increased lately but the worst case scenario has not materialized. Companies and households are entering this next stage of the economic cycle with good fundamentals and strong balance sheets. We do see a divergence in expectations from bond and equity investors: where the former appears less optimistic.

While growth may be held back by persistent inflationary pressures in the short term, investors can take a diversified approach: seeking balance between value and growth, and US and international.

Equity Price Level and Returns: All returns represent the total return for stated period. MSCI ACWI: Global equity index provided by Morgan Stanley Capital International (MSCI). S&P 500: Market capitalization index of U.S stocks provided by Standard & Poor’s (S&P). Dow Jones: Price-weighted index of U.S stocks provided by S&P. NASDAQ: Market capitalization index of U.S stocks provided by NASDAQ. Euro Stoxx 600: Market capitalization index of stocks listed in European region. MSCI Asia Ex Japan: Asia excluding Japan equity index provided by MSCI. MSCI EM: Emerging markets equity index provided by MSCI. SSE: Capitalization weighted index of all A-shares and B-shares listed on Shanghai Stock Exchange. STI: Market capitalization index of stocks listed on Singapore Exchange. SREITLSP: Market capitalization index of the most liquid real estate investment trusts in Singapore.

Fixed Income Yield and Returns: All returns represent total return for stated period. U.S. Aggregate and SBIF from Bloomberg.

Key Interest Rates: 2-Year U.S Treasuries, 10 Year Treasuries, Bloomberg. 3-month SIBOR: Singapore Interbank Offered Rates provided by Association of Banks in Singapore (ABS). Oil (WTI): Global oil benchmark, Bloomberg. Gold: Gold Spot USD/Oz, Bloomberg. Bitcoin/USD, Bloomberg. VIX: Expectation of volatility based on S&P index options provided by Chicago Board Options Exchange (CBOE).

The information provided herein is intended for general circulation and/or discussion purposes only. It does not account for the specific investment objectives, financial situation or needs of any individual. The information in this document is not intended to constitute research analysis or recommendation and should not be treated as such.

This does not constitute an offer or solicitation to buy/sell any financial instrument or to participate any investment strategy. No representation or warranty whatsoever (without limiting to accuracy, usefulness, adequacy, timeliness or completeness) in respect of any information (without limiting to any statement, figures, opinion, view or estimate). Syfe does not undertake an obligation to update the information or to correct any inaccuracy that may become apparent at a later time. All information presented is subject to change without notice. Syfe shall not be responsible or liable for any loss or damage whatsoever arising directly or indirectly as a result of any person acting on any information provided herein.

The information provided herein may contain projections or other forward-looking statement regarding future events or future performance of countries, assets, markets or companies. Actual events or results may differ materially. Past performance figures are not necessarily indicative of future of likely performance. Any reference to any specific company, financial product or asset class in whatever way is used for illustrative purposes only and does not constitute a recommendation. Investors should note that there are necessarily limitations and difficulties in using any graph, chart, formula or other device to determine whether or not, or if so, when to, make an investment. The contents hereof are considered proprietary information and may not be produced or disseminated in whole or in part without Syfe’s written consent.