Clinical Laboratory Tests Market Size to Hit USD 258

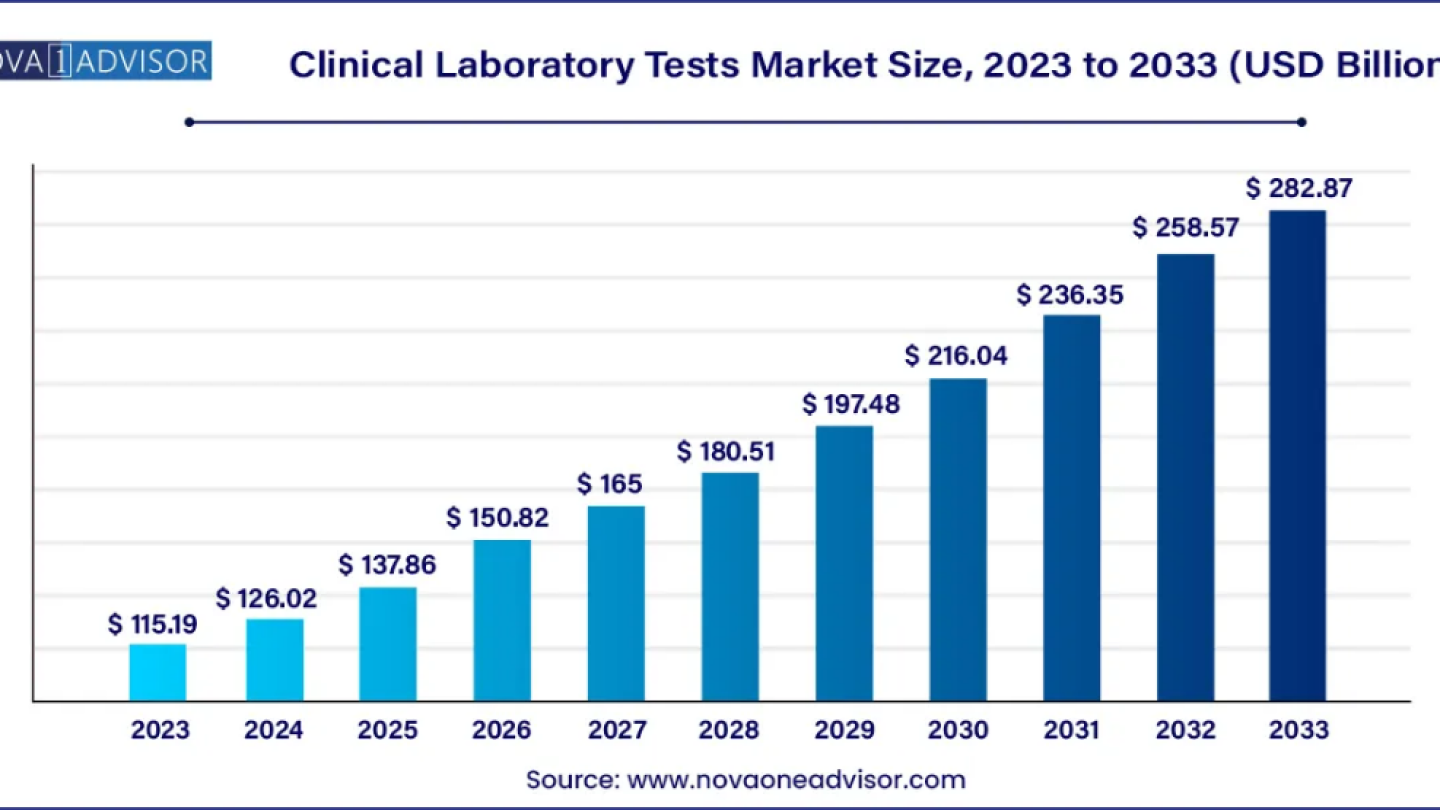

According to the latest report, the global clinical laboratory tests market size was USD 115.19 billion in 2023, calculated at USD 126.02 billion in 2024 and is expected to reach around USD 258.57 billion by 2033, expanding at a CAGR of 9.4% from 2024 to 2033. North America dominated the clinical laboratory tests market with revenue share of 49.01% in 2023.

The growing recognition of clinical laboratories as essential components of the healthcare system has significantly driven the clinical laboratory tests market. Clinicians increasingly rely on laboratory tests to confirm diagnoses and monitor patient responses to therapy, highlighting the critical role these tests play in individual patient care. The utilization of clinical laboratories for disease screening and surveillance has further underscored their value, contributing to the market’s expansion. This heightened awareness and reliance on laboratory tests represents a significant growth driver for the clinical laboratory tests market.

Full Report is Ready | Ask here for Sample Copy@ https://www.novaoneadvisor.com/report/sample/7890

Market Overview

The rapid growth of the clinical laboratory tests market is driven by their integral role in diagnostic decision-making within clinical medicine. Clinical laboratories, staffed by trained scientists and professionals such as pathologists, clinical biochemists, biomedical scientists, and technicians, perform and analyse tests on biological specimens to aid in diagnosing, treating, and managing patients. These facilities are typically located within or near hospitals to ensure accessibility for clinicians and patients. The increasing reliance on clinical laboratory test results for accurate diagnosis and patient management is a significant growth factor propelling the market forward.

- In February 2024, Arizton reported multi-billion-dollar opportunities in the US clinical laboratory tests market, forecasting more than $109 billion in revenue by 2029.

- In March 2024, Labcorp announced the acquisition of select assets from BioReference Health’s diagnostics business.

Clinical Laboratory Tests Market Key Takeaways

- North America held largest share of market in 2023 with a share of 49.01% and is expected to maintain its dominant position, in terms of share, throughout the forecast period.

- Asia Pacific is estimated to show the fastest growth in clinical laboratory tests market over the forecast period.

- HbA1c tests segment held largest revenue share in 2023 and is attributable to the increasing prevalence of diabetic population

- HGB/HCT tests segment is expected to show fastest growth rate over the forecast period owing to the growing prevalence of blood-related disorders

- Central laboratories segment dominated the market in 2023 attributable to the high market penetration and procedure volumes

Immediate Delivery is Available | Get Full Report Access@ https://www.novaoneadvisor.com/report/checkout/7890

U. S. Clinical Laboratory Tests Market Size and Share | Industry Statistics

According to the report, the U. S. clinical laboratory Tests market size was estimated at USD 39.59 billion in 2023 and is projected to hit around USD 98.71 billion by 2033, growing at a CAGR of 9.6% during the forecast period from 2024 to 2033.

North America dominates the global clinical laboratory tests market, with the U.S. performing over 14 billion tests annually, making them the most utilized medical benefit. These tests play a crucial role in saving time, reducing costs, and saving lives by enabling early disease detection and prevention. With more than 7 billion clinical lab tests conducted each year, they provide critical data for healthcare at a relatively low expenditure. This significant volume and the resulting impact underscore North America’s leading position in the market.

Asia-Pacific is experiencing the fastest growth in the global clinical laboratory tests market, driven by a strong focus on improving healthcare standards amidst its cultural and economic diversity. A survey of diagnostic laboratories in the region highlights significant advancements in quality, cost, and speed of services. Laboratory medicine development is crucial for better medical diagnosis and treatment across the vast populations in APAC. Approximately 70% of medical decisions related to early disease diagnosis, patient prognosis, and treatment selection are based on laboratory diagnostic results, underscoring the region’s rapid market growth and its commitment to enhancing healthcare outcomes.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/7890

Market Dynamics

Driver

Chronic Disease Monitoring

A significant driver of growth in the clinical laboratory tests market is the high volume of primary care testing stemming from chronic disease monitoring, driven in part by the Quality and Outcomes Framework (QOF) requirements of the General Medical Services contract. For chronic conditions necessitating long-term management, diagnostic tests are indispensable for monitoring disease progression. Regular check-ups and follow-up tests enable healthcare providers to evaluate treatment effectiveness and make necessary adjustments. These tests provide crucial information to clinicians, aiding in the accurate identification of underlying causes of patient symptoms, thereby underscoring the critical role of clinical laboratory tests in chronic disease management.

Restraint

Interpretation Challenges

The complexity of laboratory tests poses significant restraints on the growth of the clinical laboratory tests market. Even medical professionals often struggle to efficiently and accurately interpret these tests, making it even more challenging for patients, many of whom have limited health literacy and numeracy. This difficulty in interpreting test results hinders patients from taking appropriate actions, such as seeking urgent medical appointments versus scheduling regular follow-ups. The current interface of patient portals presents substantial challenges in viewing and comprehending test results. Understanding patients’ information needs, challenges, and preferences in interpreting laboratory test results is essential for designing more effective patient portals and informatics tools, highlighting a critical area that limits market expansion.

Opportunity

Technological Advancements

The clinical laboratory tests market is poised for significant growth due to advancements in laboratory testing technology. Incremental innovations enhance testing processes by making them simpler, more efficient, and cost-effective, while major breakthroughs can introduce entirely new tests or techniques. The mapping of the human genome is expected to drive rapid growth in molecular diagnostics, including genetic testing. Nanotechnology, which integrates biological and IT sciences, promises to revolutionize the field by enabling smaller, faster computer processors and exponentially increasing computational power. These technological advancements present substantial opportunities for expansion and innovation within the clinical laboratory tests market.

- In October 2022, Q² Solutions launched an innovative self-collection safety lab panel in collaboration with Tasso.

Report Highlights

By Type

The HbA1c tests category holds the largest market share in the clinical laboratory tests market. Hemoglobin A1c (HbA1c) tests measure the average blood sugar (glucose) levels over the past two to three months by assessing the percentage of glucose-coated hemoglobin in red blood cells. As blood glucose levels rise, a higher proportion of hemoglobin becomes glycated, indicating elevated blood sugar levels. This test is crucial for monitoring and managing diabetes, as a high HbA1c level signifies excessive sugar in the blood. Given its importance in diabetes diagnosis and management, the HbA1c test is a dominant segment in the market, reflecting its critical role in providing essential health insights.

Over the forecast period, the HGB/HCT tests category is projected to expand at the fastest rate in the clinical laboratory tests market. Hemoglobin (HGB) and hematocrit (HCT) tests, which are based on whole blood, are crucial for assessing various health conditions but are influenced by plasma volume. In dehydrated patients, hemoglobin and hematocrit levels appear higher, while in fluid-overloaded patients, these levels appear lower than their actual values. This rapid growth is driven by the essential role these tests play in diagnosing and managing conditions related to blood volume and overall health, making them increasingly important in clinical practice.

By End-Use

The primary clinic sector held the largest market share for clinical laboratory tests. Clinical pathology, a crucial branch of medicine, leverages laboratory testing to diagnose and manage diseases by analyzing bodily fluids, tissues, and cells to identify abnormalities. This sector plays a vital role in diagnosing diseases by detecting and quantifying various substances in the body, including blood glucose, cholesterol, and hormones. The substantial reliance on laboratory tests for accurate diagnostics and disease management in primary clinics underscores their dominant position in the clinical laboratory tests market, reflecting their essential role in delivering comprehensive healthcare services.

Over the projected timeframe, the central laboratories segment is anticipated to expand at the fastest rate. Central labs are integral to clinical trials, processing laboratory samples from study participants to generate critical data. This data offers valuable insights into the efficacy of new therapeutics, potential side effects, and differential patient benefits. The growing demand for accurate and comprehensive data in clinical trials is driving the rapid expansion of central laboratories, highlighting their essential role in advancing medical research and development.

Immediate Delivery Available | Buy This Premium Research

https://www.novaoneadvisor.com/report/checkout/7890

Clinical Laboratory Tests Market Top Key Companies:

- Quest Diagnostics Incorporated.

- Abbott

- Cinven

- Laboratory Corporation of America Holdings

- ARUP Laboratories

- OPKO Health, Inc.

- UNILABS

- Clinical Reference Laboratory, Inc.

- Synnovis Group LLP

- Sonic Healthcare Limited.

Clinical Laboratory Tests Market Recent Developments

- In March 2023, Quest Diagnostics announced the launch of Post-COVID-19 Expanded Test Panel, which includes CBC, BMP, and Hepatic Function Panel.

- In March 2023, Fluxergy announced the acquisition of InnaMed’s Blood Testing Tech for the development of metabolic panel.

- In February 2023, Detact Diagnostics, a Dutch biotech company, announced that it is setting up a new Keene State College (U.S.) laboratory with a 2-year rental contract.

- In January 2023, QIAGEN released EZ2 Connect MDx, an in vitro diagnostics platform for automated sample processing for diagnostic laboratories. The device allows labs to purify RNA and DNA samples in 30 minutes.

Clinical Laboratory Tests Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Clinical Laboratory Tests market.

By Type

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Hepatitis

- Bile Duct Obstruction

- Liver Cirrhosis

- Liver Cancer

- Bone Disease

- Autoimmune Disorders

- Others

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

By End-use

- Central Laboratories

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

- Primary Clinics

- Complete Blood Count

- HGB/ HCT testing

- Basic Metabolic Panel Testing

- BUN Creatinine Testing

- Electrolytes Testing

- HbA1c Testing

- Comprehensive Metabolic Panel Testing

- Liver Panel Testing

- Renal Panel Testing

- Lipid Panel Testing

- Cardiovascular Panel Tests

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Procure Complete Report (220+ Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.novaoneadvisor.com/report/checkout/7890

About Us

Nova One Advisor is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Nova One Advisor has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defines, among different ventures present globally.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Cancer Immunotherapy Market Size and Forecast: The global cancer immunotherapy market size was valued at USD 126.19 billion in 2023 and is projected to surpass around USD 296.01 billion by 2033, registering a CAGR of 8.9% over the forecast period of 2024 to 2033.

Immunotherapy Drugs Market : The global immunotherapy drugs market size was valued at USD 240.19 billion in 2023 and is projected to surpass around USD 1,300.38 billion by 2033, registering a CAGR of 18.4% over the forecast period of 2024 to 2033.

Monoclonal Antibody Therapeutics Market / mABs Therapeutics Market : The global monoclonal antibody therapeutics marketsize was valued at USD 233.19 billion in 2023 and is anticipated to reach around USD 919.06 billion by 2033, growing at a CAGR of 14.7% from 2024 to 2033.

Cell Therapy Market Size and Forecast: The global cell therapy market size was exhibited at USD 4.85 billion in 2023 and is projected to hit around USD 37.42 billion by 2033, growing at a CAGR of 22.67% during the forecast period 2024 to 2033.

Gene Therapy Market Size and Forecast : The global gene therapy market size was exhibited at USD 8.75 billion in 2023 and is projected to hit around USD 52.40 billion by 2033, growing at a CAGR of 19.6% during the forecast period 2024 to 2033.

Clinical Trials Market Size and Forecast: The global clinical trials market size was estimated at USD 81.90 billion in 2023 and is projected to hit around USD 153.59 billion by 2033, growing at a CAGR of 6.49% during the forecast period from 2024 to 2033.

Biologics Market Size and Forecast: The global biologics market size was estimated at USD 511.04 billion in 2023 and is projected to hit around USD 1,374.51 billion by 2033, growing at a CAGR of 10.4% during the forecast period from 2024 to 2033.

Biotechnology Market Size and Forecast: The global biotechnology market size was estimated at USD 1.54 Trillion in 2023 and is projected to hit around USD 5.68 Trillion by 2033, growing at a CAGR of 13.95% during the forecast period from 2024 to 2033.

Oncology Market Size and Forecast: The global oncology market size was estimated at USD 222.36 billion in 2023 and is projected to hit around USD 521.60 billion by 2033, growing at a CAGR of 8.9% during the forecast period from 2024 to 2033.

Cell And Gene Therapy Clinical Trials Market Size and Forecast: The global cell and gene therapy clinical trials market size reached USD 11.62 billion in 2023 and is projected to hit around USD 47.40 billion by 2033, expanding at a CAGR of 15.09% during the forecast period from 2024 to 2033.

U.S. Clinical Trials Market Size and Forecast: The U.S. clinical trials market size was valued at USD 25.81 billion in 2023 and is projected to surpass around USD 41.57 billion by 2033, registering a CAGR of 4.88% over the forecast period of 2024 to 2033.

U.S. Biotechnology Market Size and Forecast: The U.S. biotechnology market size was estimated at USD 552.49 billion in 2023 and is projected to hit around USD 1,794.11 billion by 2033, growing at a CAGR of 12.5% during the forecast period from 2024 to 2033.