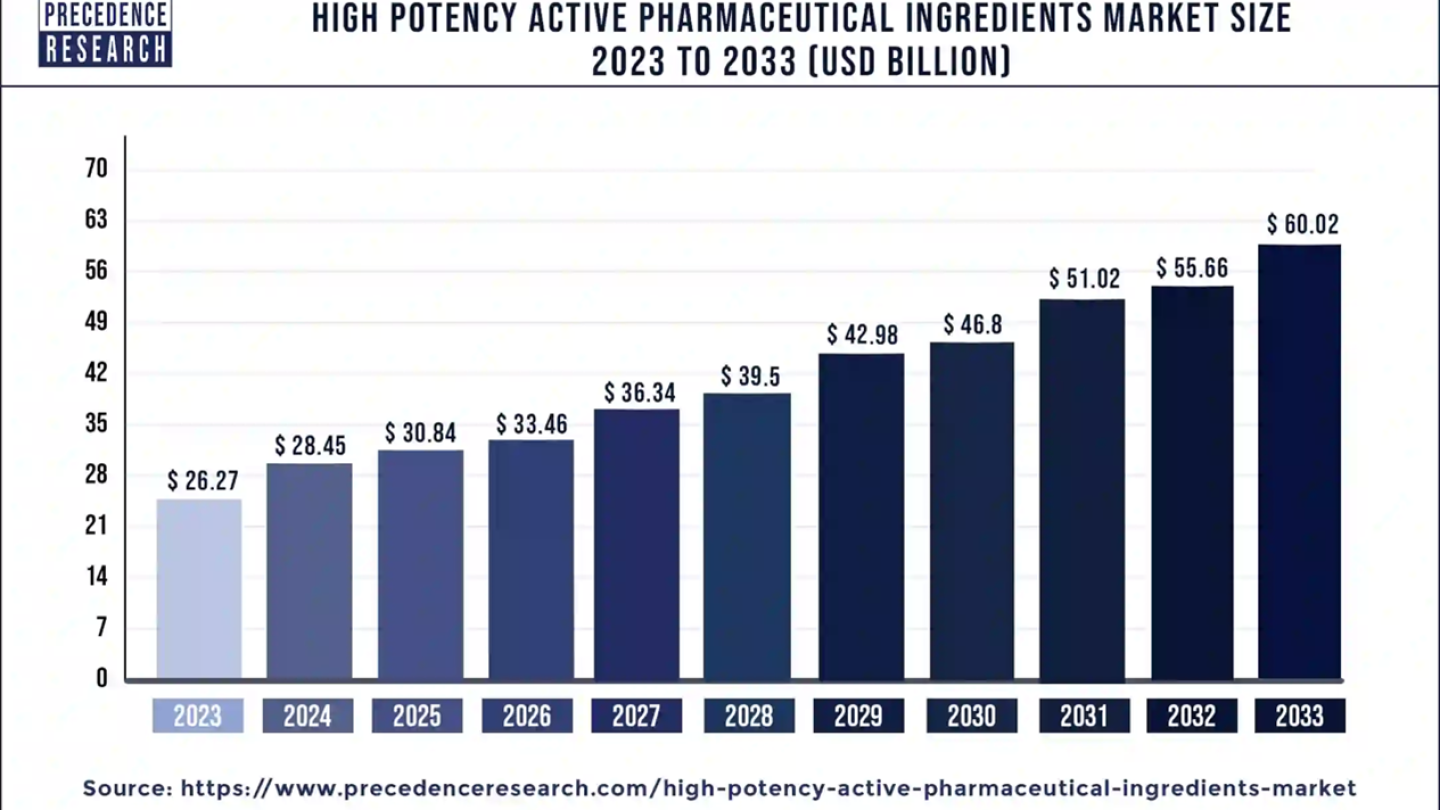

High Potency API Market Size to Worth Around US$ 60

The global high potency active pharmaceutical ingredients market size was evaluated at US$ 26.27 billion in 2023 and is expected to attain around US$ 60.02 billion by 2033, growing at a CAGR of 8.65% from 2024 to 2033. The U.S. high potency API market size is expected to hit around USD 15.96 billion by 2033 with a CAGR of 9.18% from 2024 to 2033.

The high potency active pharmaceutical ingredients market is currently undergoing rapid development due to their primary use in oncology for cancer treatment, especially ADCs. The increasing demand for highly active pharmaceutical ingredients (HPAPIs) over the last decade has led to the development of highly active pharmaceutical ingredients, primarily due to oncology research.

FREE sample includes data points, ranging from trend analyses to estimates and forecasts@ https://www.precedenceresearch.com/sample/2324

Market at a Glance

High potency active pharmaceutical ingredients market cause rapid growth due to HPAPIs are pharmaceutical drugs that contain toxic chemicals such as work doses <10 mg per day for very few people. The eight-hour weighted average exposure limit (OEL) is <10 µg/m3. As the number of active drugs in drug development increases, opportunities for HPAPI companies will also increase. The continuous expansion of the biopharmaceutical industry, especially the global needs in oncology, necessitate the development of highly active pharmaceutical ingredients (HPAPIs) and the development of modern medicine.

§ Approximately 25% of drugs in global development are classified as very potent, and this proportion is expected to increase in the coming years.

|

Company Name |

Farmabios, Novasep |

|

Headquarter |

Germany |

|

Recent Development |

In October 2022, Farmabios, Novasep and PharmaZell have announced that they are merging under the new Axplora brand. The announcement comes just six months after the closing of the merger between Novasep and the PharmaZell Group. This is the latest step in the creation of Axplora, a leading active pharmaceutical ingredient (API) development partner for pharmaceutical and biotechnology companies worldwide, with a long history of developing and improving the process for manufacturing and delivering medicines on time and at scale. Information. |

Key Takeaways

· The North America region has captured revenue share of 36.12% in 2023.

· By manufacturer type, the in-house segment has generated revenue share of 71% in 2023.

· By application, the oncology segment has held revenue share of 76% in 2023.

· By drug type, innovative drugs have held revenue share of 71.6% in 2023.

· By product, the synthetic segment has registered revenue share of 70.5% in 2023.

Buy this Premium Research Report@ https://www.precedenceresearch.com/checkout/2324

Regional Stance

The North America led the market in 2023, the region is observed to sustain the dominance in the upcoming years. Chronic disease is one of the most common and costly diseases in the United States. Nearly half of Americans (about 45%, or 133 million) live with at least one chronic disease, and that number is growing. According to the Centers for Disease Control and Prevention, chronic diseases account for nearly 75 percent of all healthcare spending in the United States alone, or about $5,300 per person per year. Policymakers and healthcare providers should prioritize reducing the spread of chronic diseases in the United States and improving the overall health and well-being of affected communities.

|

Company Name |

API Innovation Center (APIIC) |

|

Headquarter |

United States |

|

Recent Development |

In May 2023, API Innovation Center (APIIC) is exploring a business plan with Missouri pharmaceutical companies Mallinckrodt Pharmaceuticals (SpecGx LLC), Apertus Pharmaceuticals, and Sentio BioSciences. The APIIC’s goal is to collaborate and partner with organizations across the board. These organizations are interested in the domestic production of APIs and are therefore committed to working with APIIC to achieve this goal. |

Recent Breakthroughs in High Potency Active Pharmaceutical Ingredients Market

· In July 2023, Evonik and Heraeus Precious Metals are partnering to expand the two companies’ services to include high-performance pharmaceutical ingredients (HPAPI). The integration leverages the unique HPAPI capabilities of both companies to offer customers integrated products from pre-production to commercial production.

· In March 2024, Roquette, a global leader in botanical ingredients and pharmaceutical excipients, today announced an agreement that strengthens its position as a key partner to the pharmaceutical industry by acquiring IFF Pharma Solutions, a global pharmaceutical excipient manufacturer for the oral portfolio.

Report Highlights

By Product

The synthetic category accounted for the greatest market share in the high potency active pharmaceutical ingredients market. Synthetic API, these are chemical compounds made from a variety of chemical compounds. Examples include aspirin, paracetamol, and many antibiotics. For example, synthetic APIs are specifically designed to mimic the structure and function of natural substances, including proteins, enzymes, and hormones. More importantly, these APIs are accepted by industry professionals because they are easy to create, have a long shelf life, and can be modified to better serve their specific functions.

By Drug Type

Because of increased R&D efforts for the development of novel pharmaceuticals and favorable government policies, innovative drugs accounted for the largest market share in the high potency active pharmaceutical ingredients market. New research and development, as well as major government regulations, have driven innovation in the pharmaceutical industry. Medical care innovations range from drug discovery to drug therapy, with the goal of improving treatment through the use of novel pharmaceuticals and techniques. Clinical innovations are pharmaceutical drugs that yield superior results.

Over the projected period, generic medication molecules are anticipated to grow at the fastest rate in the high potency active pharmaceutical ingredients market. Generic drugs can be less expensive than branded drugs because they do not require repeated animal and clinical studies (human) to demonstrate the safety and effectiveness of branded drugs. Multiple generics are often offered for the same product, creating competition in the market and often leading to lower prices.

By Application

Due to the substantial use of HPAPIs in oncology medications, the oncology segment had the greatest sales share in the high potency active pharmaceutical ingredients market. The demand for highly active pharmaceutical ingredients (HPAPI) is increasing in the oncology and general pharmaceutical industries. Since these active ingredients are used in lower doses, they cause fewer side effects in patients and require less API manufacturing. Oncology research, cancer treatment and other treatments have made the availability of potent pharmaceutical ingredients (HPAPIs) constant in the global high potency active pharmaceutical ingredients market.

By Manufacturer Type

In-house manufacturer segment is dominated in the high potency active pharmaceutical market. In-house manufacturing refers to the idea of duplicating previous processes and procedures. It differs from outsourcing, which is usually used as a cost measure or when a company does not have the resources (usually people, machines, technology or other skills) to consider certain procedures. Traditional manufacturing or in-house manufacturing is an activity performed within the same business. Having an in-house manufacturing team makes it easier to focus on quality products.

Related Reports

· Viral Vectors & Plasmid DNA Manufacturing Market: https://www.precedenceresearch.com/viral-vectors-and-plasmid-dna-manufacturing-market

· Healthcare Staffing Market: https://www.precedenceresearch.com/healthcare-staffing-market

· Glaucoma Market: https://www.precedenceresearch.com/glaucoma-market

Market Dynamics

Driver

Advances in Targeted Oncology Therapies

The rapid growth of the high potency active pharmaceutical market is that HPAPIs are pharmaceutical drugs that contain toxic chemicals such as work doses <10 mg per day for very few people. The eight-hour weighted average exposure limit (OEL) is <10 µg/m3. As the number of active drugs in drug development increases, opportunities for HPAPI companies will also increase. The continuous expansion of the biopharmaceutical industry, especially the global needs in oncology, necessitate the development of highly active pharmaceutical ingredients (HPAPIs) and the development of modern medicine. Approximately 25% of drugs in global development are classified as very potent, and this proportion is expected to increase in the coming years.

Restraint

Safety Risks in Production

Highly potent pharmaceutical ingredients (HPAPIs) pose a significant risk to professionals and non-professionals during manufacturing, with potential consequences including serious illness and liability. Mistakes made when using HPAPIs can lead to dangerous risks and large fines, causing financial and operational losses for pharmaceutical companies.

Relying on specialist contracting companies increases the risk, as any incident involving contamination or non-compliance can have serious consequences that could lead to business failure. The formation of HPAPI into a highly micronized material, almost oil-like, depending on the density of the mixture, increases the risk of contamination. Therefore, the growth of the highly potent pharmaceutical ingredients market is limited due to high risks and strict regulations.

Opportunity

Advances in Drug Discovery

Rapid Developments in Biomedical Science are driving research to shorten the development time to provide incredible medical care. This dynamic environment presents a unique opportunity for the high potency pharmaceutical ingredient market as the project requires the use of toxicological and pharmacological data resulting in limited or unclear HPAPI classification to obtain drug synthesis. It is important to strike a balance between environmental, health, and safety (EHS) decisions, regulatory compliance, rapid clinical trials, and patient access speed.

By utilizing manufacturing and testing facilities, hiring experienced and trained personnel, and using a robust, risk-based approach, pharmaceutical companies can create an integrated system for compounding and manufacturing drugs. This approach not only enables a smooth transition from clinical-to-clinical stage, but also enhances the evolution of the high potency active pharmaceutical ingredient market response to meet emerging therapeutic needs.

Top Companies in the High Potency Active Pharmaceutical Ingredients Market

§ BASF SE

§ CordenPharma

§ Dr. Reddy’s Laboratories Ltd.

§ CARBOGEN AMCIS AG

§ Pfizer, Inc.

§ Sun Pharmaceutical Industries, Ltd.

§ Teva Pharmaceutical Industries Ltd.

§ Albany Molecular Research, Inc.

§ Sanofi S.A.

§ Merck & Co., Inc.

§ Novartis AG

Market Segmentation

- By Product

- By Manufacturer Type

- By Drug Type

- By Application

- Oncology

- Hormonal Disorders

- Glaucoma

- Others

By Geography

· North America

· Europe

· Asia Pacific

· Latin America

· Middle East & Africa (MEA)

Get Full Access of this Report@ https://www.precedenceresearch.com/checkout/2324

USA : +1 650 460 3308 | IND : +91 87933 22019 | Europe : +44 2080772818

Email@ sales@precedenceresearch.com