Q2 2024 Cross-Comparison of Public Hospital Operator Performance

Join Lumeris’ Rick Goddard, Mercy’s Michael Englehart, and me on Tuesday, September 24 in a virtual event where we’ll be diving into the latest news in health and health systems, plus a chat of what we can expect for 2025, like:

- Vertical integration dynamics and how health systems should respond

- Health system revenue diversification and transformation

- Effective, proven growth and partnership strategies for health systems

There will also be a live Q&A session and a recording available. Feel free to submit questions ahead of time! Register Here

Cross-Comparison of Public Hospital Operators from Q2

Today concludes my series on public hospital operator Q2 performance. Specifically we’re taking a dive into comparable performance across all 5 publicly traded peers.

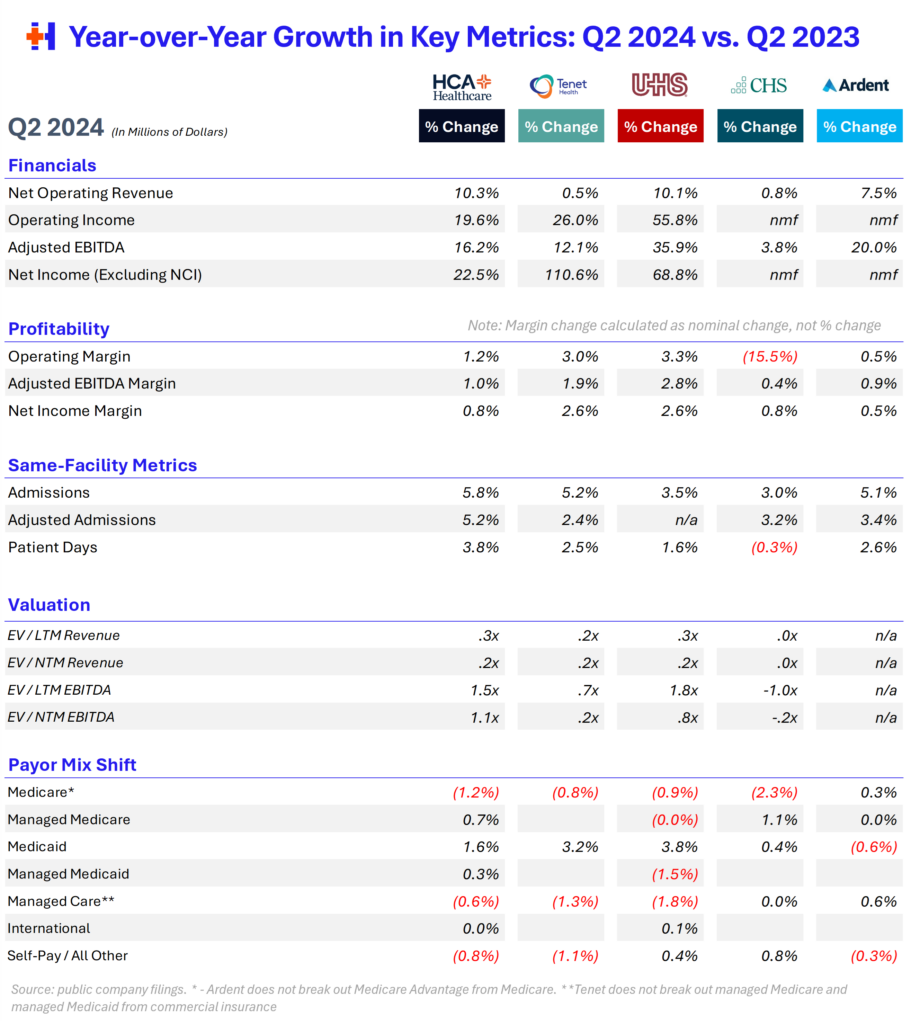

In case you’ve missed my past several sends, the trend in the table below is abundantly clear: publicly traded hospitals are enjoying a nice season of margin recovery, as every single hospital operator saw adjusted EBITDA and net income margin expansion. Same-facility metrics continue to hold strong – and remember, Q2 2023 was when the elevated utilization trend really kicked in, so these results are pretty telling. Meanwhile, average length of stay dropped across all operators, signaling more capacity in the post-acute space.

The table below depicts year-over-year growth for various key metrics during Q2 2024 vs. Q2 2023 reported uniformly across operators. Each column represents that hospital operator’s growth/change over the prior period:

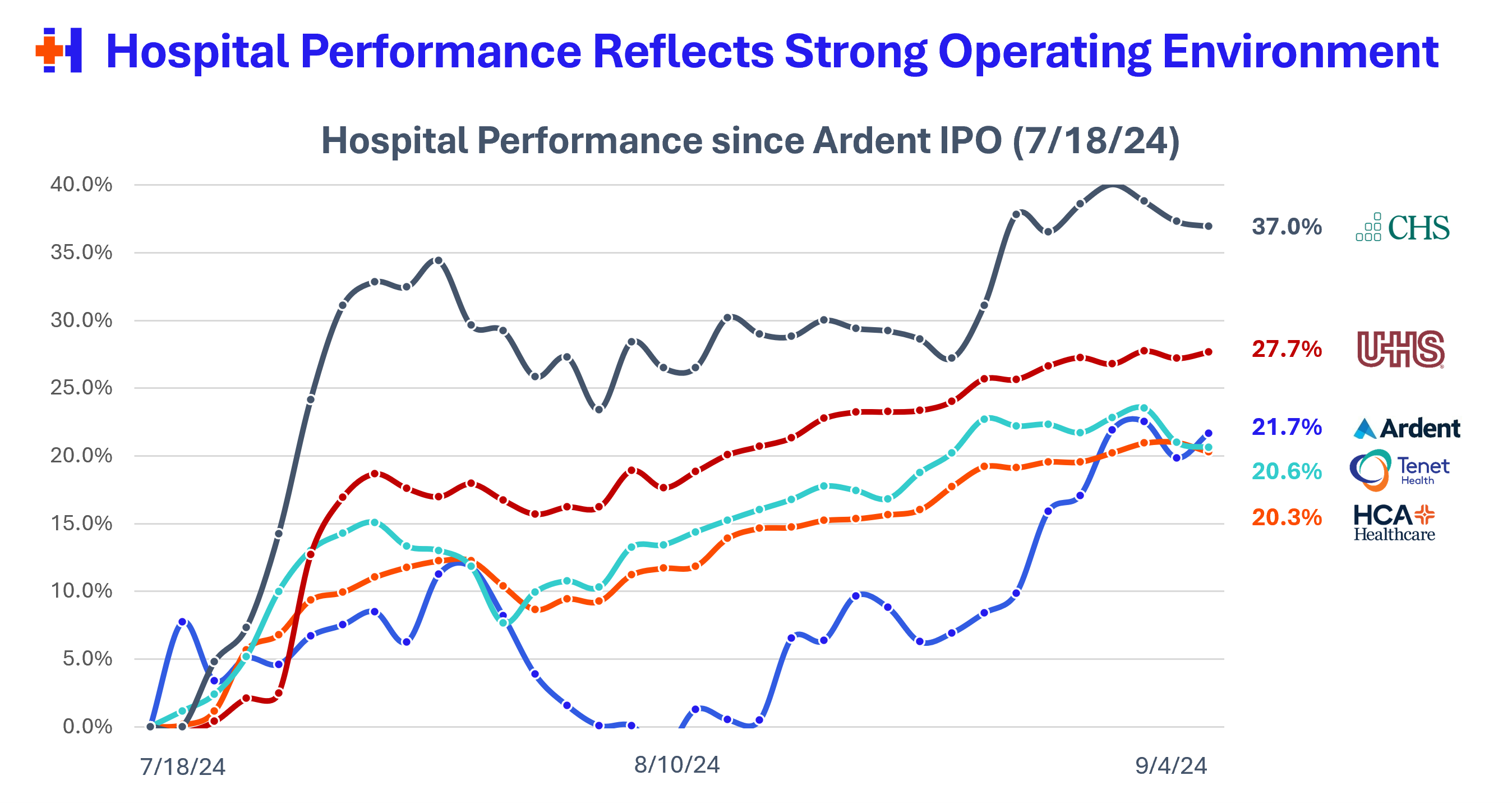

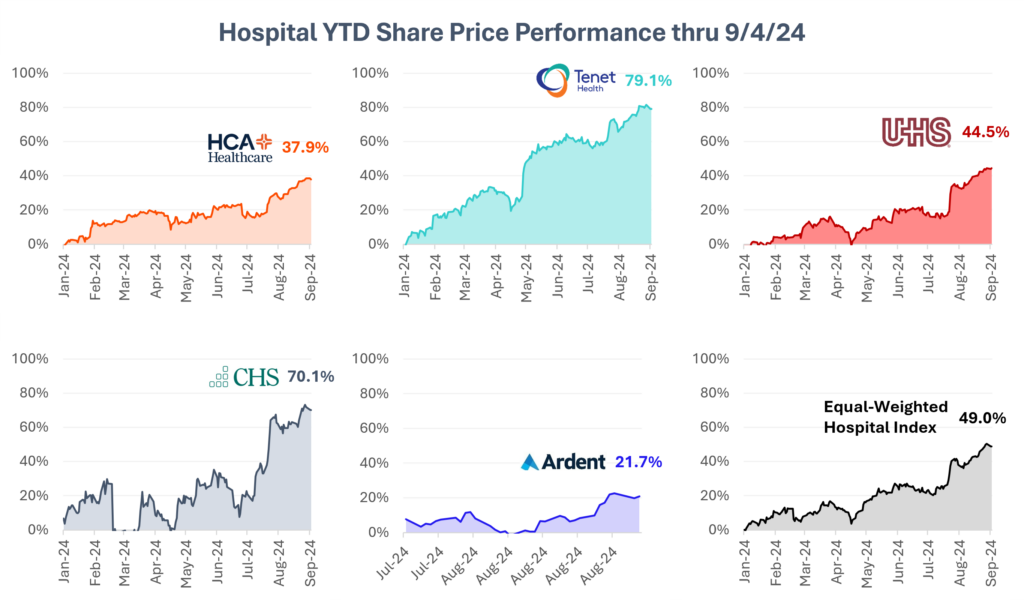

Moving over to share performance, hospitals’ collective performance on the public markets exemplifies the rosy operating environment for the sector in 2024 as all are up and to the right, with multiple expansion in most names as well:

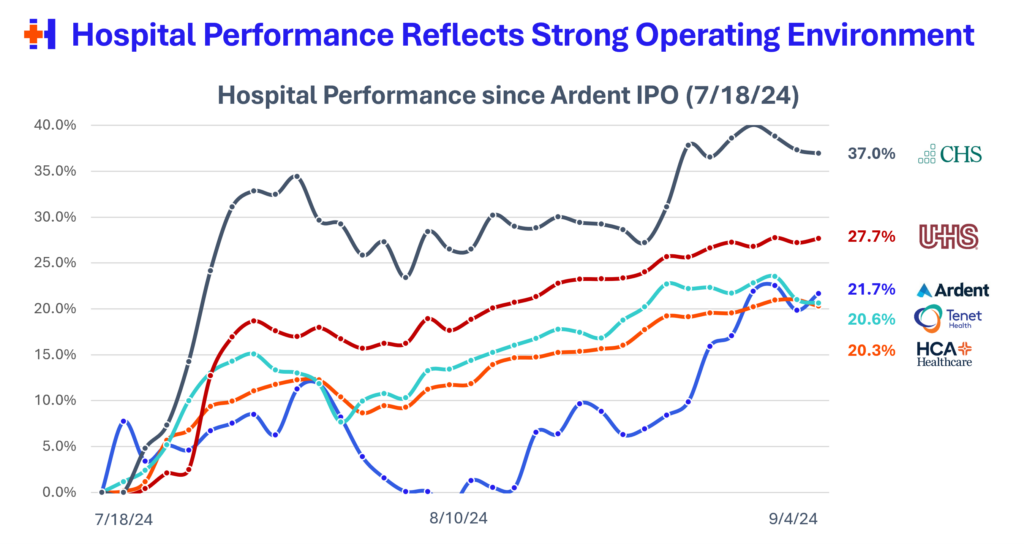

Since Ardent’s IPO on 7/18 (my cherrypicked datapoint), the S&P 500 has traded relatively flat. Meanwhile, hospitals have, well…crushed it:

I thought this quote from Tenet was particularly interesting when discussing post-Covid demand trends. Essentially that long-term demand will boil down to population and demographics trends, while Tenet management expects the next 5 years to hold at this elevated utilization level as a new baseline, and grow from there:

Well, I think inpatient utilization is building and growing primarily because of 2 fundamental things in the marketplace. One is just the consistent growth in the aging or aging population and especially with respect to those that have chronic diseases. I mean that trend hasn’t stopped. And it’s a fundamental tailwind for the hospital sector, in my belief, at least into the early part of the next decade, if you just look at the demographics.

And then you have the second issue, which, it’s kind of the unfortunate consequence that happened with COVID where you had 1 million premature deaths that actuarially would have — in their last 5 years of life, most of those people would have ended up succumbing to some other disease over a 5-year period but they all died up front. And the number is probably even larger than that. And so what’s happening is, I think, every year you have more people aging into “that last 5 years of life.”

So you would just naturally expect 5 years of recovery after the beginning of COVID. I mean that’s just mathematically and actuarially seems pretty simple to me to understand. It’s a question of how you then as a provider, manage your physician staffing, physical capacity in order to service that demand. And I think that’s what we’re seeing right now. I don’t see the utilization dropping over time, I just see it kind of reaching steady state at some point. And then we build from there, mostly just on the population growth side.

Tenet Healthcare, Q2 2024 earnings call